Posted on Aug 18, 2023

30-year-fixed-rate-mortgage-reaches-its-highest-level-over

7.36K

18

5

11

11

0

Mortgage Rates Rise

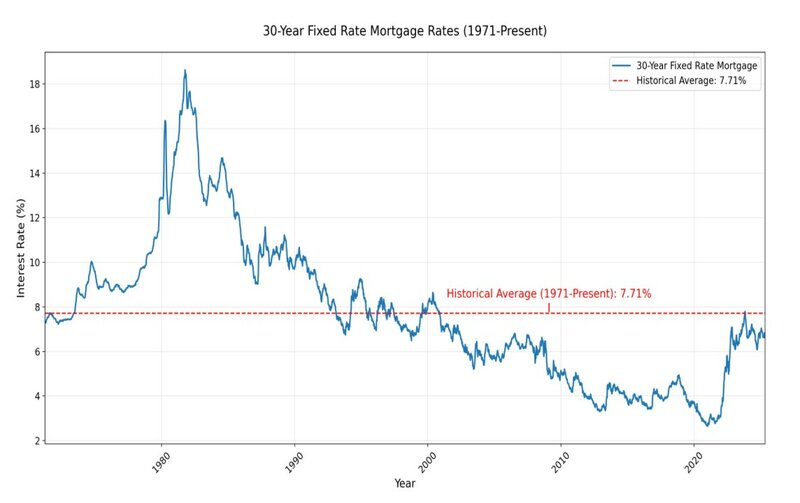

The average rate for the most common type of mortgage in the US has risen to almost 7.1%, according to data from a survey of lenders made by mortgage financing giant Freddie Mac. The figure—for 30-year fixed-rate loans—is the highest since December 2001 and is up two percentage points over the past year (and more than 4.4 points from the all-time low seen in January 2021).

Among other factors, mortgage rates are influenced by the Federal Reserve, which hiked the federal funds rate from 0% to 5.25-5.5% over the past year and a half in an effort to fight inflation. Higher mortgage rates mean higher costs for would-be homebuyers and tend to cause a slowdown in the housing market. Sales of existing homes dropped by almost 19% year-over-year in June, according to reports—though the median price increased to $410K, close to an all-time high.

For context, a buyer making a 20% down payment on the median-priced house would pay $465K in interest over the life of a 30-year fixed-rate mortgage (see calculator)—more than the cost of the house itself. https://www.mortgagecalculator.org/

The average rate for the most common type of mortgage in the US has risen to almost 7.1%, according to data from a survey of lenders made by mortgage financing giant Freddie Mac. The figure—for 30-year fixed-rate loans—is the highest since December 2001 and is up two percentage points over the past year (and more than 4.4 points from the all-time low seen in January 2021).

Among other factors, mortgage rates are influenced by the Federal Reserve, which hiked the federal funds rate from 0% to 5.25-5.5% over the past year and a half in an effort to fight inflation. Higher mortgage rates mean higher costs for would-be homebuyers and tend to cause a slowdown in the housing market. Sales of existing homes dropped by almost 19% year-over-year in June, according to reports—though the median price increased to $410K, close to an all-time high.

For context, a buyer making a 20% down payment on the median-priced house would pay $465K in interest over the life of a 30-year fixed-rate mortgage (see calculator)—more than the cost of the house itself. https://www.mortgagecalculator.org/

30-year-fixed-rate-mortgage-reaches-its-highest-level-over

Posted from freddiemac.gcs-web.com

Edited >1 y ago

Posted >1 y ago

Responses: 4

Posted >1 y ago

Who can afford housing any more,Even rent ,My Rent went from ,$545.00 - $ 875.00, and my bills are in a while wind cause of it,I takened aback and do not see the end in site,Outside trusting God,

(4)

Comment

(0)

Lt Col Charlie Brown

>1 y

Wow...that's quite the jump. We're dealing with real estate taxes here...ours have more than doubled over the past five years

(2)

Reply

(0)

Posted >1 y ago

I thought that Bidenomics took care of the inflation!

(1)

Comment

(0)

Posted 28 d ago

Historical records show that the average interest rate % for 30-year fixed rate mortgages from 1971-2025 is 7.71%. Close to where we are right now. Average, for the last 54 years...

The highest annual average interest rate was 16.64% in 1981. (Reagan) The lowest rate was 2.96% in 2021. (Biden). There's no question that rates went up over President Biden's term. That low of around 3% was the lowest I've seen in my lifetime and was not going to hold either way.

Let's see where they stabilize.

The highest annual average interest rate was 16.64% in 1981. (Reagan) The lowest rate was 2.96% in 2021. (Biden). There's no question that rates went up over President Biden's term. That low of around 3% was the lowest I've seen in my lifetime and was not going to hold either way.

Let's see where they stabilize.

(0)

Comment

(0)

Read This Next

Housing

Housing Money

Money Home Loan

Home Loan Mortgage

Mortgage