4

4

0

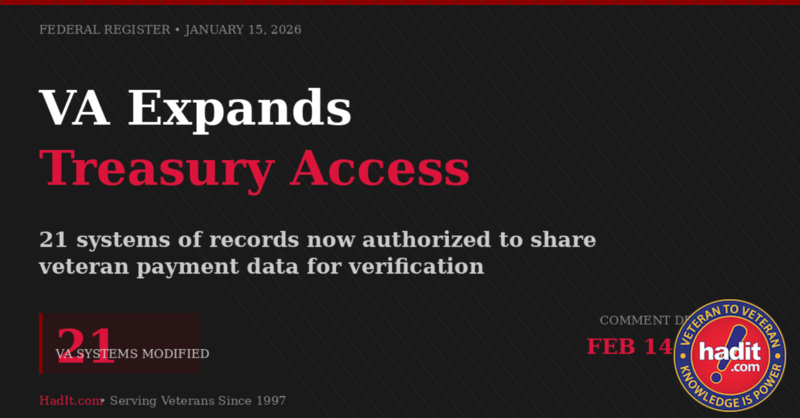

The VA Just Expanded Treasury's Access to Your Payment Data

On January 15, the VA modified 21 Systems of Records to share veteran payment data with Treasury's "Do Not Pay" verification system—used to flag potential improper payments before they're issued.

Compensation. Pension. Education. Caregiver stipends. Home loans. All of it now flows through expanded automated verification.

The concern? The VA generated $5.1 billion in overpayments over the last four years—mostly from their own processing errors. When automated verification flags a discrepancy, it can trigger debt collection through Treasury's Offset Program. The system doesn't distinguish between fraud and VA mistakes.

Veterans reported changes that never got processed nationally. Paperwork that disappeared into the system. Eight-year delays on updates they submitted correctly—then retroactive debt demands.

Comment deadline is February 14, 2026.

Full breakdown with sources and comment links https://hadit.com/va-treasury-data-sharing-do-not-pay-2026/

On January 15, the VA modified 21 Systems of Records to share veteran payment data with Treasury's "Do Not Pay" verification system—used to flag potential improper payments before they're issued.

Compensation. Pension. Education. Caregiver stipends. Home loans. All of it now flows through expanded automated verification.

The concern? The VA generated $5.1 billion in overpayments over the last four years—mostly from their own processing errors. When automated verification flags a discrepancy, it can trigger debt collection through Treasury's Offset Program. The system doesn't distinguish between fraud and VA mistakes.

Veterans reported changes that never got processed nationally. Paperwork that disappeared into the system. Eight-year delays on updates they submitted correctly—then retroactive debt demands.

Comment deadline is February 14, 2026.

Full breakdown with sources and comment links https://hadit.com/va-treasury-data-sharing-do-not-pay-2026/

The VA Just Expanded Treasury's Access to Your Payment Data—Here's Why That Matters

Posted from hadit.comPosted in these groups:  Benefits

Benefits Disability

Disability

Benefits

Benefits Disability

Disability

Edited 12 d ago

Posted 16 d ago

Responses: 4

Posted 15 d ago

Troubling to say the least, and happening in more than just these areas.

(4)

Comment

(0)

COL Randall Cudworth

13 d

Jack, you are correct in that it is occurring in different areas. It’s happening throughout every Department in the Federal Government as well as federally funded, state administered programs (such as Medicaid, SNAP, etc.) and has been moving this way for years (some faster than others).

The reason is that they are implementing the Payment Integrity Information Act of 2019* which required OMB to develop a system to cut down on improper payments and for the previously mentioned entities to use it. OMB directed the Department of Treasury to be the lead agency for developing a single point of entry that would consolidate the different ‘eligibility’ databases from various Departments, and what Treasury developed is the Do Not Pay system.

PO1 Theresa Aldrich, I’m disappointed with what you posted. In addition to most of the information you give being completely wrong, the tone of your post is closer to the “scary boogeyman” type that I usually only see from the partisan political posters instead of the type I would see in one that is trying to inform the veteran community.

The Do Not Pay system is NOT a debt collection system nor is it an “automated clawback machine” - your entire portrayal of it is incorrect. The only thing that the Do Not Pay system does is verify eligibility to help prevent improper payments. Furthermore, if the system does find a match (i.e., the payee isn’t eligible for the payment), it doesn’t stop the payment – the system notifies the VA that a match was found to be ineligible and why. The VA will make the decision to proceed with the payment or not. The sole case where the Do Not Pay system would stop a VA payment is if a match for the payee is found in the Death Master File from the Social Security Administration’s database (which is also integrated into the Do Not Pay system).

The Department of Treasury DOES have automated debt collection systems, with the relevant one being the Treasury Offset Program*. The VA, and every single federal agency plus many states, participate in TOP because federal law requires all federal agencies (state participation is optional) to send debts that are over 120 days delinquent to Treasury’s Bureau of the Fiscal Service for collection. It’s been doing that for almost three decades since the Debt Collection Improvement Act of 1996 *became law, so the VA didn’t “just connect your benefits to Treasury’s debt collection system.”

You are mostly correct that “Compensation. Pension. Education. Caregiver stipends. Home loans. All of it now flows through automated verification” because the VA has been using the Treasury’s Payment Automation Manager (PAM) since 2013, which integrates verification as part of payment authorizations from the agency. I say ‘mostly’ because it doesn’t “now” go through automated verification – it’s been doing that for almost 13 years.

As your post links to entries on the Federal Registry, that was there instead of looking further into the background of the systems, the underlaying reasons for the FR notifications, and that you may have made assumptions regarding what they are or the impact they will have. For example, the VA is rescinding the SOR 71VA53 because the information is already covered under a SOR from OPM. Why? Because the data it refers to is primarily INTERNAL VA OIG data which is already present on OPM systems (the majority being OIG employees) and they are eliminating the VA redundant system (in some limited situations, such as being involved in an OIG investigation, there may be veteran’s PII in the OPM system). However, you imply something nefarious is going on with your statement, “The OIG investigates fraud. Restructuring their records during an aggressive improper payment enforcement push isn't coincidence.”

I usually appreciate your efforts to keep the veteran community informed, but I considering the information and context from this post more “fearmongering” rather than “informative”. The VA has a multitude of issues as well as success stories. I’ve no issue with anyone presenting information that focuses on the issues instead of the successes in an effort to bring awareness to them, but I do have issues when the information presented is incorrect and/or has context given to them is crafted to fit a personal narrative.

--------------------------------

* Payment Integrity Information Act of 2019 - https://www.congress.gov/bill/116th-congress/senate-bill/375

* Treasury Offset Program - https://fiscal.treasury.gov/top/

* Do Not Pay FAQ - https://fiscal.treasury.gov/dnp/faqs.html

* Debt Collection and the Debt Collection Improvement Act of 1996 (DCIA) fact sheet from the Bureau of the Fiscal Service - https://fiscal.treasury.gov/files/debt-management/DMS-FactSheet-DCIA.pdf

REF: Modernizing the VA Financial Acquisition Management System - https://digital.va.gov/general/modernizing-the-va-financial-acquisition-management-system/

The reason is that they are implementing the Payment Integrity Information Act of 2019* which required OMB to develop a system to cut down on improper payments and for the previously mentioned entities to use it. OMB directed the Department of Treasury to be the lead agency for developing a single point of entry that would consolidate the different ‘eligibility’ databases from various Departments, and what Treasury developed is the Do Not Pay system.

PO1 Theresa Aldrich, I’m disappointed with what you posted. In addition to most of the information you give being completely wrong, the tone of your post is closer to the “scary boogeyman” type that I usually only see from the partisan political posters instead of the type I would see in one that is trying to inform the veteran community.

The Do Not Pay system is NOT a debt collection system nor is it an “automated clawback machine” - your entire portrayal of it is incorrect. The only thing that the Do Not Pay system does is verify eligibility to help prevent improper payments. Furthermore, if the system does find a match (i.e., the payee isn’t eligible for the payment), it doesn’t stop the payment – the system notifies the VA that a match was found to be ineligible and why. The VA will make the decision to proceed with the payment or not. The sole case where the Do Not Pay system would stop a VA payment is if a match for the payee is found in the Death Master File from the Social Security Administration’s database (which is also integrated into the Do Not Pay system).

The Department of Treasury DOES have automated debt collection systems, with the relevant one being the Treasury Offset Program*. The VA, and every single federal agency plus many states, participate in TOP because federal law requires all federal agencies (state participation is optional) to send debts that are over 120 days delinquent to Treasury’s Bureau of the Fiscal Service for collection. It’s been doing that for almost three decades since the Debt Collection Improvement Act of 1996 *became law, so the VA didn’t “just connect your benefits to Treasury’s debt collection system.”

You are mostly correct that “Compensation. Pension. Education. Caregiver stipends. Home loans. All of it now flows through automated verification” because the VA has been using the Treasury’s Payment Automation Manager (PAM) since 2013, which integrates verification as part of payment authorizations from the agency. I say ‘mostly’ because it doesn’t “now” go through automated verification – it’s been doing that for almost 13 years.

As your post links to entries on the Federal Registry, that was there instead of looking further into the background of the systems, the underlaying reasons for the FR notifications, and that you may have made assumptions regarding what they are or the impact they will have. For example, the VA is rescinding the SOR 71VA53 because the information is already covered under a SOR from OPM. Why? Because the data it refers to is primarily INTERNAL VA OIG data which is already present on OPM systems (the majority being OIG employees) and they are eliminating the VA redundant system (in some limited situations, such as being involved in an OIG investigation, there may be veteran’s PII in the OPM system). However, you imply something nefarious is going on with your statement, “The OIG investigates fraud. Restructuring their records during an aggressive improper payment enforcement push isn't coincidence.”

I usually appreciate your efforts to keep the veteran community informed, but I considering the information and context from this post more “fearmongering” rather than “informative”. The VA has a multitude of issues as well as success stories. I’ve no issue with anyone presenting information that focuses on the issues instead of the successes in an effort to bring awareness to them, but I do have issues when the information presented is incorrect and/or has context given to them is crafted to fit a personal narrative.

--------------------------------

* Payment Integrity Information Act of 2019 - https://www.congress.gov/bill/116th-congress/senate-bill/375

* Treasury Offset Program - https://fiscal.treasury.gov/top/

* Do Not Pay FAQ - https://fiscal.treasury.gov/dnp/faqs.html

* Debt Collection and the Debt Collection Improvement Act of 1996 (DCIA) fact sheet from the Bureau of the Fiscal Service - https://fiscal.treasury.gov/files/debt-management/DMS-FactSheet-DCIA.pdf

REF: Modernizing the VA Financial Acquisition Management System - https://digital.va.gov/general/modernizing-the-va-financial-acquisition-management-system/

(1)

Reply

(0)

PO1 Theresa Aldrich

12 d

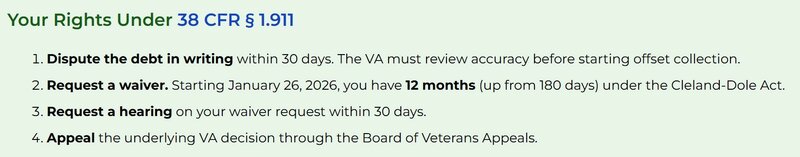

COL Randall Cudworth, thank you for the detailed correction—I appreciate you taking the time to clarify the technical distinctions between Do Not Pay and the Treasury Offset Program. You're absolutely right that I conflated the two systems, and that matters for accuracy.

I should have been clearer: DNP is an eligibility verification system, not a debt collection tool. TOP handles actual collections, and yes, the VA has been connected to Treasury payment systems since 2013 through PAM. The January 15 action was SORN modifications to expand data sharing within existing infrastructure, not a brand new connection.

That said, I stand by the substantive concern.

When the VA generates $5.1 billion in overpayments over four years—mostly from their own processing errors—and then expands automated verification across 21 systems of records, the technical distinction between "flagging" and "collecting" doesn't provide much comfort to veterans. Whether a payment gets frozen by an automated flag or clawed back through TOP, the result for someone living on fixed income is the same: financial disruption caused by VA mistakes.

The OIG consolidation may well be routine administrative cleanup. But when it happens simultaneously with aggressive improper payment enforcement and expanded data sharing during a broader policy shift, veterans have every reason to ask questions. Transparency isn't fearmongering—it's due diligence.

I'll revise the post to correct the technical errors you identified, because accuracy matters. But I won't soften the call for veterans to understand these systems and submit comments. The 30-day window closes February 14, and most veterans still don't know this is happening.

Thanks again for holding me accountable on the details. The veteran community benefits when we get this stuff right.

I should have been clearer: DNP is an eligibility verification system, not a debt collection tool. TOP handles actual collections, and yes, the VA has been connected to Treasury payment systems since 2013 through PAM. The January 15 action was SORN modifications to expand data sharing within existing infrastructure, not a brand new connection.

That said, I stand by the substantive concern.

When the VA generates $5.1 billion in overpayments over four years—mostly from their own processing errors—and then expands automated verification across 21 systems of records, the technical distinction between "flagging" and "collecting" doesn't provide much comfort to veterans. Whether a payment gets frozen by an automated flag or clawed back through TOP, the result for someone living on fixed income is the same: financial disruption caused by VA mistakes.

The OIG consolidation may well be routine administrative cleanup. But when it happens simultaneously with aggressive improper payment enforcement and expanded data sharing during a broader policy shift, veterans have every reason to ask questions. Transparency isn't fearmongering—it's due diligence.

I'll revise the post to correct the technical errors you identified, because accuracy matters. But I won't soften the call for veterans to understand these systems and submit comments. The 30-day window closes February 14, and most veterans still don't know this is happening.

Thanks again for holding me accountable on the details. The veteran community benefits when we get this stuff right.

(1)

Reply

(0)

Posted 16 d ago

Situations like this are going to become even more common.

https://www.wtsp.com/article/news/local/pinellascounty/veteran-overpayment-va/67-4c19fec2-1323-44a0-9b20-a2d39b3aa555

https://www.wtsp.com/article/news/local/pinellascounty/veteran-overpayment-va/67-4c19fec2-1323-44a0-9b20-a2d39b3aa555

'I'm scared': Vietnam veteran among thousands impacted by overpayment issues at VA

Lawmakers on Capitol Hill pressed U.S. Department of Veterans Affairs officials on what can be done to "erase" the debt.

(2)

Comment

(0)

SPC Joshua Blotzer

16 d

'I'm afraid they're gonna take everything': Marine veteran gets letter from VA saying he needs to...

Thousands of low-income veterans receiving pension payments from the VA are being told they were overpaid and need to pay it back.

(1)

Reply

(0)

Read This Next