Posted on Jun 29, 2015

Does Ending Tax Exemptions Means Ending Churches?

12.4K

53

42

3

3

0

I'm speechless! People of faith will always find a place to worship. Underestimating the strength of worshipping can only make it stronger. IMHO

Mark Oppenheimer writes the biweekly “Beliefs” column for The New York Times and is editor-at-large for Tablet. He also reports for The Atlantic, The Nation, This American Life, and elsewhere.

The Supreme Court's ruling on gay marriage makes it clearer than ever that the government shouldn't be subsidizing religion and non-profits.

http://time.com/3939143/nows-the-time-to-end-tax-exemptions-for-religious-institutions/

Mark Oppenheimer writes the biweekly “Beliefs” column for The New York Times and is editor-at-large for Tablet. He also reports for The Atlantic, The Nation, This American Life, and elsewhere.

The Supreme Court's ruling on gay marriage makes it clearer than ever that the government shouldn't be subsidizing religion and non-profits.

http://time.com/3939143/nows-the-time-to-end-tax-exemptions-for-religious-institutions/

Posted >1 y ago

Responses: 13

It's not just about Churches but all religious institutions, to include universities and hospitals. There are certainly organizations out there that abuse the tax exempt status for profit but for the most part being tax exempt lowers operating costs for these organizations, allowing money that would otherwise have to be paid in taxes to be used to further their mission.

The writer argues that charity from these organizations would decrease by an unknown margin but that it could be made up for by the additional monies the government would receive. The problem with that is it is based on the assumption that the organization would still be able to operate and pay these taxes and that the government would use the additional money to subsidized what charity (soup kitchens, food banks, etc.) was lost.

I also have to question what the impact is in changing the non-profit/charitable status to that of a "for profit" business when it comes to protecting religious freedom under the various federal and state laws. The precedence has been set by the cases in several states that "for profit" businesses cannot decline to provide their services for events that go against their religious beliefs. So if an evangelical Church holds weddings they would not be able to deny a same sex couple from getting married there, or a Catholic University/Bible College not recognizing a same sex marriage for cohabitation housing.

In the end taking away the tax exempt status may cause the Church building to close its doors but the body will still find a way to gather and worship, it is those in need in the local communities whom these organizations support and provide comfort that will suffer the most.

The writer argues that charity from these organizations would decrease by an unknown margin but that it could be made up for by the additional monies the government would receive. The problem with that is it is based on the assumption that the organization would still be able to operate and pay these taxes and that the government would use the additional money to subsidized what charity (soup kitchens, food banks, etc.) was lost.

I also have to question what the impact is in changing the non-profit/charitable status to that of a "for profit" business when it comes to protecting religious freedom under the various federal and state laws. The precedence has been set by the cases in several states that "for profit" businesses cannot decline to provide their services for events that go against their religious beliefs. So if an evangelical Church holds weddings they would not be able to deny a same sex couple from getting married there, or a Catholic University/Bible College not recognizing a same sex marriage for cohabitation housing.

In the end taking away the tax exempt status may cause the Church building to close its doors but the body will still find a way to gather and worship, it is those in need in the local communities whom these organizations support and provide comfort that will suffer the most.

(4)

(0)

SGT (Join to see)

PO1 Dustin Adams, both of us think the same thing. The wood and brick can be torn down, but the Church people will live on to worship wherever they can find.

(1)

(0)

SSG Gene Carroll SR.

All I have to say if the government would do as much for people as the church's do around the world. We would be better off. The government tax and tax and still dose not know how to manage money, all they can is barrow more and give to other nations instead of helping a lot of people in the USA that need help. with real health care and food shortages. WE used to have food given away by the government years ago. But no longer, We sending everything overseas. If they could learn to manage the funds better then they would need the church money and other organizations money. Blessed is those who labor and work and get away of thing somebody owes them the world.

(0)

(0)

As an Associate Pastor of a small church, I am all for ending tax exemption for Churches as a whole. Allow their charitable arms to be tax exempt. IE. the church itself should be taxed, but any transfers it makes from it's O&M budget to it's charity arm which would be tax exempt in it's own right (say a soup kitchen) would be a tax deductible donation for the church.

Here is why I don't think a church should be tax exempt. The IRS gets to determine what is and isn't a church. They even have a document that helps define it (http://www.irs.gov/pub/irs-tege/eotopica94.pdf). You will often hear about the "14-Points" the IRS uses.

1. Distinct legal existence

2. Recognized creed and form of worship

3. Definite and distinct ecclesiastical government

4. Formal code of doctrine and discipline

5. Distinct religious history

6. Membership not associated with any other church or denomination

7. Organization of ordained ministers

8. Ordained ministers selected after completing prescribed courses of studies

9. Literature of its own

10. Established places of worship

11. Regular congregations

12. Regular religious services

13. Sunday schools for religious instruction of the young

14. Schools for preparation of its ministers

A Church doesn't have to have all, but the IRS ultimately determines if a church qualifies. That said, churches are automatically exempt (http://www.irs.gov/Charities-&-Non-Profits/Churches,-Integrated-Auxiliaries,-and-Conventions-or-Associations-of-Churches) and don't have to apply for 501c3, but the IRS can come back and retroactively say a church isn't church enough to be tax exempt. I think a reasonable person can clearly see this is a true violation of the establishment clause and the only way to NOT violate the establishment clause is to not grant exemption to church, but only to the actual charitable functions themselves.

/rant

Here is why I don't think a church should be tax exempt. The IRS gets to determine what is and isn't a church. They even have a document that helps define it (http://www.irs.gov/pub/irs-tege/eotopica94.pdf). You will often hear about the "14-Points" the IRS uses.

1. Distinct legal existence

2. Recognized creed and form of worship

3. Definite and distinct ecclesiastical government

4. Formal code of doctrine and discipline

5. Distinct religious history

6. Membership not associated with any other church or denomination

7. Organization of ordained ministers

8. Ordained ministers selected after completing prescribed courses of studies

9. Literature of its own

10. Established places of worship

11. Regular congregations

12. Regular religious services

13. Sunday schools for religious instruction of the young

14. Schools for preparation of its ministers

A Church doesn't have to have all, but the IRS ultimately determines if a church qualifies. That said, churches are automatically exempt (http://www.irs.gov/Charities-&-Non-Profits/Churches,-Integrated-Auxiliaries,-and-Conventions-or-Associations-of-Churches) and don't have to apply for 501c3, but the IRS can come back and retroactively say a church isn't church enough to be tax exempt. I think a reasonable person can clearly see this is a true violation of the establishment clause and the only way to NOT violate the establishment clause is to not grant exemption to church, but only to the actual charitable functions themselves.

/rant

(5)

(1)

SGT (Join to see)

TSgt Joshua Copeland, so how would your church fare if it were to lose any tax exemptions? Several churches in Pasadena have shut their doors despite having the tax exemptions. If those same churches, in their beginning, did not receive exemptions, they would have never opened the doors at all.

(1)

(0)

SSG Gene Carroll SR.

What would it be like for me to loose my 501c3 I'm under the church pastor but my program is strictly helping veterans and their families of all wars that we when threw and those going threw now. Even if we don't do any marriages. Vets loose too.

(0)

(0)

TSgt Joshua Copeland

SSG Gene Carroll SR., you would likely qualify for 501(c) status on your own without the church.

(0)

(0)

Interesting article but the author has a problem with his selective fire toggle. NFPs who are not churches would probably be the largest ally to the churches as there is a big constitutional wedge. Churches in general wouldn't be treated equally, hence a problem. Some churches are so heavy into political activism, that encourages government intervention for all churches. Scientology got a pass because the Feds decided not to take a ride on the slippery slope. So it's a mixed bag. If you don't line something, you want the government to do something about it.

The other thing is the term "Profit". So what becomes the new definition of profit? What's "income". The liberal/socialist side would want to push "value added". My value is different from yours. Bottom line, a bunch of meandering whining that doesn't contribute to anything.

BTW unions are typically NFPs as well as a 527 PACs. Good luck with that too. Now a discussion on tightening up what things a NFP can involve themselves in would be OK by me. How about no political endorsements, campainging, lobbying, etc. by any NFP? Careful because there are negatives with going that way too. You thought tinkering with Social Security was the third rail? Killing the 527 tax exemption would be nuclear.

The other thing is the term "Profit". So what becomes the new definition of profit? What's "income". The liberal/socialist side would want to push "value added". My value is different from yours. Bottom line, a bunch of meandering whining that doesn't contribute to anything.

BTW unions are typically NFPs as well as a 527 PACs. Good luck with that too. Now a discussion on tightening up what things a NFP can involve themselves in would be OK by me. How about no political endorsements, campainging, lobbying, etc. by any NFP? Careful because there are negatives with going that way too. You thought tinkering with Social Security was the third rail? Killing the 527 tax exemption would be nuclear.

(3)

(0)

PO1 Dustin Adams

By some accounts Scientology got its tax exempt status by overwhelming the IRS with a tsunami of law suits across the US. Basically they told the IRS to grant the tax exempt status and the law suits would go away, and rather than fight the IRS caved.

(1)

(0)

I don't see it as a way to shut them down, though I get it. If a lot of them can't afford the property taxes they would have to forfeit the property like everyone else. I think some how the state should get it's "tithe" from religious organizations somehow. In the immortal words of George Carlin, "If they want to have their say, let them pay the admissions fee like everybody else."

(3)

(0)

SGT (Join to see)

MAJ Robert (Bob) Petrarca, Sir I do agree. Churches ask for tithes which are supposed to help the church survive. Our government needs tithes from churches for the same reason. As long as those tithes to our Government, goes where it's supposed to go, it should make our countries coffers more able to support churches and other "Non" profit organizations survive. Like I stated in my question, all the churches they cause to close won't stop religions from existing. they will find somewhere to exist.

(1)

(0)

TSgt Joshua Copeland

MAJ Robert (Bob) Petrarca, being a Federal 501c3 does not automatically mean they don't have to pay property taxes. In many places, they still do as that is a State/Local tax. Many areas do exempt property tax for 501c3's but that is on a location by location basis.

(2)

(0)

That's what this court is trying do, they give you a choice, Marry them or loose you 501c3 or pay fine or go to jail or prison, Sounds to me like another step to dictatorship. If the president to be dosen't stop this crap we will be taken over so be on the look out what we fought for is going down in a hand basket. I sure hat to see this happen. But it is here on us. Believe it or not.

(2)

(0)

SGT (Join to see)

Oh, I believe it SSG Gene Carroll SR.. Our country is going down the tubes and nothing we can do about it except get someone in office who really cares about us and America, and turns things around.

(0)

(0)

SGT (Join to see), You might already know that there are several people on RP that would like to see the church weakened and eventually crumble.

(2)

(0)

SGT (Join to see)

SSG (ret) William Martin, Yes I know. I don't want this to become about religion or Christians. It's about whether the government may or may not stop giving churches tax exemptions. From what I've read many churches don't need tax exemptions to survive. I did not realize that. One my chief complaints is the government wasting money, on scientific experiments, which could be used for more beneficial projects that are real and not experiments.

(0)

(0)

MAJ Keira Brennan

I am on of them here on RP.I’d love to tour the Vatican, Nordic Stave churches and some of the more ancient and houses of worship just like I toured the quiet dead ruins of Luxor and Giza.

(0)

(0)

Funny how they always attack Christians but never any other religion, some of which have far more radical views.

(2)

(0)

TSgt Joshua Copeland

SSG John Erny, I didn't see anything in the article that would limit to just "Christian" Churches.

(1)

(0)

SSG John Erny

SGT (Join to see) - That an it would not fit their PC agenda to pick on a minority religion.

(1)

(0)

MAJ Keira Brennan

I am for taking religious tax credits from A to Z. A as in Abrahamic religions to Z as Zoroastrianism. Toss in a J for Jainism and Judaism. An H for Hinduism. How about M for Moonies and Mormans. A fat S for Scientologist. And even though I am an ORDAINED MINISTER we can add a D for Dude’ism. I am sure I missed quite a few as religions are like the plague.

(0)

(0)

It is my firm belief that marriage is a religious practice and custom. The government should not have involved itself in a religious practice if it intends to keep a seperation between church and state. The license of a marriage is something our country did to try to control a custom thousands of years old. Tax breaks and inheritance laws should be made on some other basis than if you have completed a religious ritual or not. By the way I am a pastor and I don't want anyone to tell me how to worship. That is why I served

(1)

(0)

SGT (Join to see)

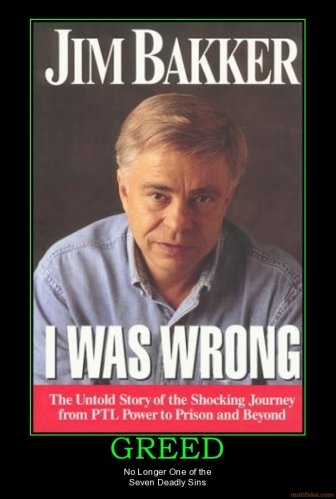

Good on you Sgt Stephen Browning. Religion is not supposed to be about the money, but it does. The false pretense of God before money has hurt a lot of folks who got suckered in by the evangelist liars.

(0)

(0)

Sgt Stephen Browning

It is very true that there are many who use religion to line their pockets. The very thought of someone getting rich by taking money in the name of God is sickening to me. I am a pastor and I don't ask for or take any money at all for anything. I love to worship God and help others. I work 7 days a week at dyno _nobel and still can pastor. The ones who abuse the people of God make it look bad.

(0)

(0)

SGT (Join to see)

That's so true Kelli. My church is my home. I've been going there for over 35 years.

(1)

(0)

Read This Next

Religion

Religion Government

Government Church

Church